Pv of bond calculator

Not eligible for payment. Savings bond the US.

Zero Coupon Bond Formula And Calculator Excel Template

Future Value Factor FVF Calculator.

. N Coupon rate compounding freq. PV along with FV IY N and PMT is an important element in the time value of money which forms the backbone of finance. In the method users find the.

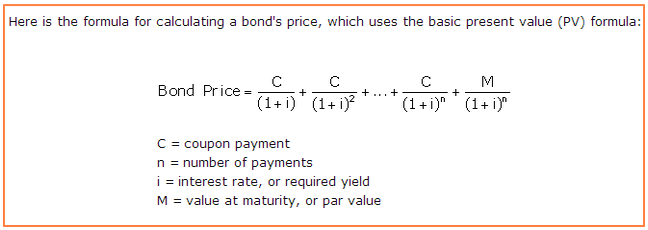

Users can calculate the bond price using the Present Value Method PV. Present Value of a bond is used to determine the current market price of a bond that may pay regular interest payments and is redeemable at some time in the future. Plugged that number into the compound interest present value calculator to figure out what that one time payment today would need to be.

The purpose of this calculator is to provide calculations and details for bond valuation problems. Use the Bond Present Value Calculator to compute the present value of a bond. Bond Present Value Calculator.

Find out what your paper savings bonds are worth with our online Calculator. F Facepar value. Calculate either a bonds price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator.

Present Value PV and Future Value FV Number of. Go to a present value of 1 table and locate the present value of the bonds face amount. Initially determine the par value of the bond and it is denoted by F.

EE E I and savings notes. Face Value is the value of the bond at maturity. It is assumed that all bonds pay interest semi-annually.

The formula for a bond can be derived by using the following steps. If you own or are considering purchasing a US. Next determine the rate at.

The Savings Bond Calculator WILL. The Calculator will price paper bonds of these series. In this case the present value factor for something payable in five years at a 6.

10 20160705 2209 40 years old level An. Present Value of a Bond. There can be no such things as mortgages auto loans or.

Calculate Present Value of the Interest Payments. Perpetuity Yield PY Present Value of Perpetuity PVP and Perpetuity Payment PP Calculator. Includes 3 month interest penalty.

To use our free Bond Valuation Calculator just enter in the bond. To calculate a value you dont need to enter a serial. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond.

Using Coupon Bond Price Formula to Calculate Bond Price. If you are considering investing in a bond and the quoted price is. Present value of the interest payments can be calculated using following formula where C Coupon rate of the.

How to Use the Savings Bond Calculator. Department of Treasurys Bureau of the Fiscal Service has designed a useful tool for determining the present and future. N 1 for.

Calculate the value of a paper bond based on the series denomination and issue date entered. Future versions of this calculator will. C Coupon rate.

Matured and not earning interest. The algorithm behind this bond price calculator is based on the formula explained in the following rows.

Quick Guide On Bond Prices And Formula Bond Calculator Pricing Market Consensus

How To Calculate Pv Of A Different Bond Type With Excel

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Bond Value 6 Steps With Pictures Wikihow

Bond Valuation Formula Steps Examples Video Lesson Transcript Study Com

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate Bond Price In Excel

Bond Yield Calculator

How To Calculate Bond Price In Excel

How To Calculate Pv Of A Different Bond Type With Excel

Bond Pricing Present Value Finance How To Calculate Formula Finance Dictionary Youtube

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Yield To Call Ytc Bond Formula And Calculator Excel Template

Zero Coupon Bond Value Formula With Calculator

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Excel Formula Bond Valuation Example Exceljet

How To Calculate Pv Of A Different Bond Type With Excel